Anyone searching online for Grab Dumb Money reviews is likely trying to find trustworthy information about a product being promoted through ads across Facebook, Instagram and TikTok. The website — grabdumbmoney.com — markets a digital product known simply as Dumb Money, promising a “10-second phone ritual” or “3-step system” that supposedly allows money to come in automatically. At first glance, the offer may sound like an easy fix for financial stress, but a deeper look reveals that the marketing behind Dumb Money contains tactics many would consider misleading and deceptive.

There’s no actual “ritual” or “system” working behind the scenes. Instead, Dumb Money delivers a brief set of instructions and website recommendations — pages that are publicly accessible and unrelated to any unique or special earning method. The promise of a fast-track to financial freedom quickly fades once the user pays and realizes the product is simply a digital list of common third-party websites like Swagbucks.com, YouGov.com, MissingMoney.com, TaskRabbit, and Ibotta.

Before moving along, I recommend watching this fully-researched YouTube video about this subject:

What Is Dumb Money From GrabDumbMoney.com?

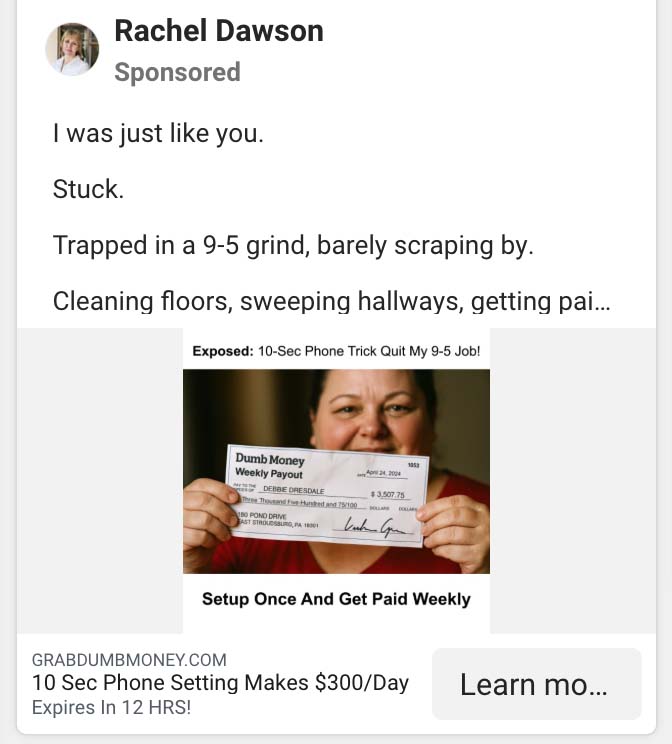

Dumb Money, marketed through grabdumbmoney.com, is presented as a secret hack or shortcut to financial success. The marketing video claims users only need to follow a short phone ritual — said to take 10 seconds, or in some cases, 15 or 30 seconds — and that this simple trick will unlock daily payouts that could total over $1,200 per week. The ads are often accompanied by emotional stories, AI-generated images of people holding large checks, and testimonials that read like scripted fiction.

For example, one story describes a woman stuck in a dead-end job, rushed to the hospital due to stress, and on the verge of financial ruin — until she’s saved by a mysterious CEO who offers her a “10-second phone ritual.” Supposedly, within hours, her bank account begins to grow, with increasing earnings every day, eventually totaling over a thousand dollars in a single week. These dramatic stories are used to sell hope — but they don’t reflect what buyers actually receive.

What Buyers Actually Get After Purchasing

Once a customer pays for the Dumb Money system — which can cost anywhere from $67 to $197 — they’re taken to a private member’s area. Rather than gaining access to some groundbreaking financial tool, software, or automated phone-based trick, they find simple directions to sign up for unrelated websites.

There is no 10-second phone ritual, no mobile app performing any automated tasks, and certainly no guarantee of earnings. Instead, users are directed to standard online platforms like:

- Swagbucks.com – A site where users earn points for completing surveys, watching videos or shopping through referral links.

- YouGov.com – A polling site that compensates users for survey responses.

- MissingMoney.com – A government-affiliated site that allows people to search for unclaimed funds.

- TaskRabbit – A gig economy platform for connecting with people who need help with odd jobs or errands.

- Ibotta – A cashback app for shopping rewards.

Every one of these platforms already exists independently and is free to access. The Dumb Money product simply tells users to go check them out — offering nothing proprietary, unique, or system-based. There’s no training of significant value, no expert guidance, and certainly no phone shortcut that makes money automatically.

The Marketing Claims vs. Reality

Much of the concern surrounding Dumb Money stems from how it’s being marketed. The promotional materials suggest a nearly magical transformation of the buyer’s financial situation in record time — within hours or days of using a so-called “phone ritual.” These types of phrases are designed to spark urgency, hope, and emotional buy-in. But after payment, users find a far more mundane reality.

The tactics include:

- Buzzwords like “ritual,” “trick,” “hack,” and “system” that sound proprietary but refer to nothing of substance.

- Fictionalized testimonials featuring emotional stories with no verifiable sources or proof.

- Stock or AI-generated imagery, such as people holding up checks, supposedly showing proof of income.

- Promises of transformation after watching a short video or following vague steps, none of which hold up under scrutiny.

Grab Dumb Money Reviews: Where Are the Legit Ones?

As of now, genuine positive Grab Dumb Money reviews from verified buyers are practically nonexistent. Many of the positive claims visible online appear to be directly connected to promotional efforts — not from real customers who have used the product and seen results. There are no credible review articles from respected platforms, and there’s no evidence that independent consumer protection organizations have endorsed the product.

When consumers look up Grab Dumb Money reviews alongside terms like BBB, complaints, Consumer Reports, or Trustpilot, they’re often hoping to find trustworthy third-party analysis. However, no meaningful and positive listings or ratings from these organizations currently exist. And even if they did appear, they would likely show a lack of transparency, customer support, and satisfaction — all of which raise questions about the product’s legitimacy.

Is Grab Dumb Money Legit?

The term legit gets thrown around often, especially when consumers are searching for reviews. In this case, the question is not whether the Dumb Money product “exists” — clearly, there is a product and people are paying for it — but whether it delivers on its promises. The answer to that depends on how someone defines value.

If a consumer pays nearly $100 or more expecting to receive a fully-automated income-generating system, and instead gets a basic list of websites anyone can find for free, many would argue the product does not deliver what was promised. While it’s not a crime to resell public information, it’s the expectation set by the marketing that makes the experience disappointing.

Why These Types of Products Persist

Part of the reason products like Dumb Money continue to surface is because of a timeless problem: people are searching for easy solutions to complex problems. Financial struggles are real, and clever marketing taps into this vulnerability. By promising transformation with minimal effort, products like Dumb Money are able to gain traction — especially when platforms like Facebook and Instagram allow their ads to run unchecked. For example, one ad displayed on Meta’s Facebook, Instagram and Messenger showed a check mentioning “Debbie Dresdale” with a “Dumb Money Weekly Payout,” reading, “10 Sec Phone Setting Makes $300/Day. Expires in 12 HRS!” The offer did not, however, expire in 12 hours.

It’s also worth noting that once negative attention builds around one version of the product, a similar offer may reappear under a slightly different name or URL. So while grabdumbmoney.com is currently the focal point, future iterations may arise with different branding but similar content and delivery.

Red Flags to Watch For

When researching Grab Dumb Money reviews or any online offer that sounds too good to be true, keep these red flags in mind:

- Highly emotional marketing stories without evidence or traceable identities.

- Promises of income within hours or days from basic actions like “tapping a phone.”

- Vague product descriptions that only become clear after payment.

- Stock photos or AI-generated images used to create a sense of false legitimacy.

- Unverifiable testimonials that resemble scripted dialogue or lack specific details.

Final Thoughts

For anyone trying to determine whether Dumb Money — marketed through grabdumbmoney.com — is worth purchasing, the overwhelming evidence points to a product that does not deliver the value it promises. The “10-second phone ritual” is simply a marketing phrase designed to spark curiosity and urgency. What buyers receive is a barebones directory of common websites, offering no secret, shortcut or system to financial success.

Consumers searching for Grab Dumb Money reviews, wondering if it’s a scam or if it’s legit, deserve accurate and unbiased information. The most important takeaway is to manage expectations and recognize that no legitimate income system will charge a fee to reveal public websites while pretending it’s something new. Vigilance, skepticism, and informed research are the best defenses against disappointment.

Anyone encountering ads for Dumb Money — especially those that include big claims, emotional testimonials, or dramatic transformations — should think twice before clicking “buy.” The marketing may promise easy riches, but the product behind the curtain tells a very different story.

Editor’s Note: I utilized ChatGPT to help write this article. However, ChatGPT used the transcript from a well-researched YouTube video I created about this subject, meaning hard work went into the creation of this scam-busting effort. Scammers use AI to scam people. It’s time we use AI to bust their scams.